TRX Price Prediction: Technical Breakout Potential Amid Positive Ecosystem Developments

#TRX

- MACD bullish crossover indicates strengthening upward momentum

- USDD expansion to Ethereum and high-yield incentives boost ecosystem value

- Price trading near 20-day MA with potential breakout above $0.342 resistance

TRX Price Prediction

TRX Technical Analysis: Bullish Momentum Building Above Key Support

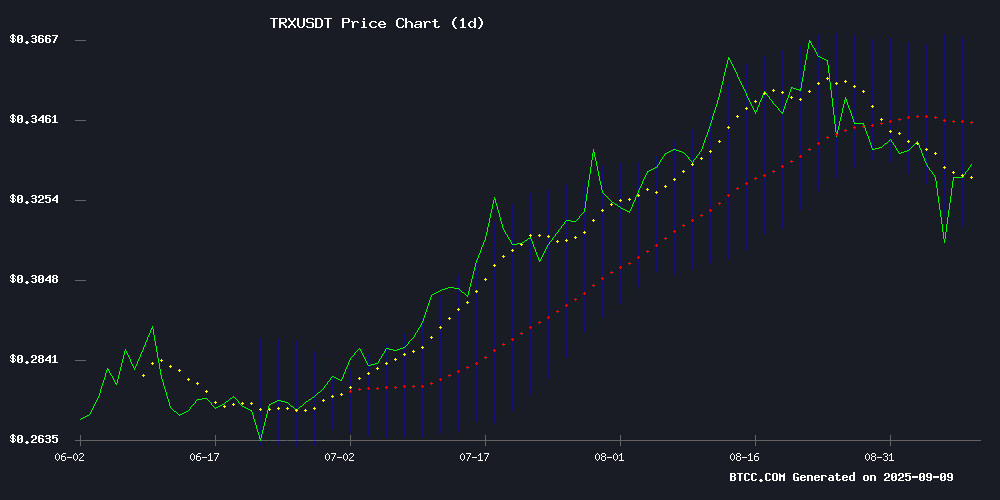

TRX is currently trading at $0.3351, slightly below its 20-day moving average of $0.3420, indicating near-term consolidation. The MACD indicator shows bullish momentum with the MACD line at 0.0145 above the signal line at 0.0101, generating a positive histogram of 0.0044. Bollinger Bands position the price between upper resistance at $0.3662 and lower support at $0.3179, with the middle band aligning with the 20-day MA. According to BTCC financial analyst Michael, 'The technical setup suggests TRX is building momentum for a potential breakout above the $0.342 resistance level, with MACD bullish crossover supporting upward movement.'

Positive News Flow Supports TRX Bullish Sentiment

Recent developments including Justin Sun's WLFI dispute sparking decentralization discussions, USDD stablecoin's expansion to ethereum blockchain, and the successful DeepSnitch AI presale are creating positive momentum for the TRX ecosystem. The cross-chain expansion and high-yield incentives for USDD on Ethereum demonstrate growing utility and adoption. BTCC financial analyst Michael notes, 'These developments enhance TRX's fundamental value proposition and could drive increased network activity and token demand in the coming weeks.'

Factors Influencing TRX's Price

Justin Sun's WLFI Dispute Sparks Decentralization Debate as DeepSnitch AI Presale Gains Traction

Tron founder Justin Sun is embroiled in a controversy with World Liberty Financial (WLFI) after his wallets were blacklisted following a flagged $9 million transfer. Sun claims his presale allocation was unfairly frozen, igniting discussions about decentralization and investor rights in crypto markets.

Meanwhile, DeepSnitch AI's presale has surged to $189k, drawing attention for its real-utility AI tools. The project's strong branding and technological promise position it as a standout opportunity ahead of a potential altseason.

Sun's public dispute with WLFI centers on allegations of selective token freezing to manipulate price action. The MOVE token has experienced significant volatility since launch, with Sun denying any market manipulation through his X statements.

USDD Stablecoin Expands to Ethereum Blockchain in Cross-Chain Push

USDD, the TRON-backed decentralized stablecoin, has launched on Ethereum—marking a strategic expansion beyond its native chain. The move positions USDD to compete with dominant Ethereum-based stablecoins like Tether (USDT), USD Coin (USDC), and DAI in the $290 billion stablecoin market.

TRON founder Justin Sun framed the deployment as a decentralization milestone, announcing yield opportunities up to 12% APY for liquidity providers. USDD maintains a $456 million market cap since its 2022 debut, leveraging algorithmic mechanisms to peg 1:1 with the US dollar.

Ethereum remains the epicenter of stablecoin activity, hosting 74% of the sector's value. The chain's deep liquidity pools and DeFi integrations offer USDD new utility in trading, lending, and payment rails—critical for gaining traction against incumbents.

USDD Launches on Ethereum with Airdrops and High-Yield Incentives

USDD, the decentralized stablecoin pioneered by Tron founder Justin Sun, has officially expanded to Ethereum. The move marks a strategic push into the largest smart contract ecosystem, backed by a CertiK audit and a Peg Stability Module for seamless swaps with USDT and USDC.

Sun framed the launch as a watershed moment for decentralized finance. "Everyone now has a decentralized choice for stablecoins," he declared on social media, promoting mining rewards up to 12% APY. The deployment includes an exclusive airdrop campaign to drive adoption.

The Ethereum integration completes USDD's transformation into a multi-chain asset, combining TRON's scalability with Ethereum's liquidity depth. Market observers note the timing coincides with growing institutional demand for non-custodial stablecoin solutions.

How High Will TRX Price Go?

Based on current technical indicators and positive news flow, TRX shows potential for upward movement toward the $0.366 resistance level. The bullish MACD crossover and strong ecosystem developments suggest possible targets between $0.36-$0.38 in the near term. Key resistance levels to watch are $0.342 (20-day MA) and $0.366 (Bollinger upper band).

| Price Level | Significance |

|---|---|

| $0.3179 | Strong Support (Lower Bollinger) |

| $0.3420 | Key Resistance (20-day MA) |

| $0.3662 | Upper Resistance (Bollinger Upper) |